Unlock eWholesale

10,000+ Products in Just 4 Steps!

Become a member

Self Register Call Now

Human assisted Under

15-Minutes*

Everything you need to dominate.

Built to move volume, fast.

Ship Faster, sell quicker

Everything you need to dominate.

Built to move volume, fast.

Ship Faster, sell quicker

Self Register Call Now

Human assisted Under

15-Minutes*

Provide essential business information, including

your company name and contact details.

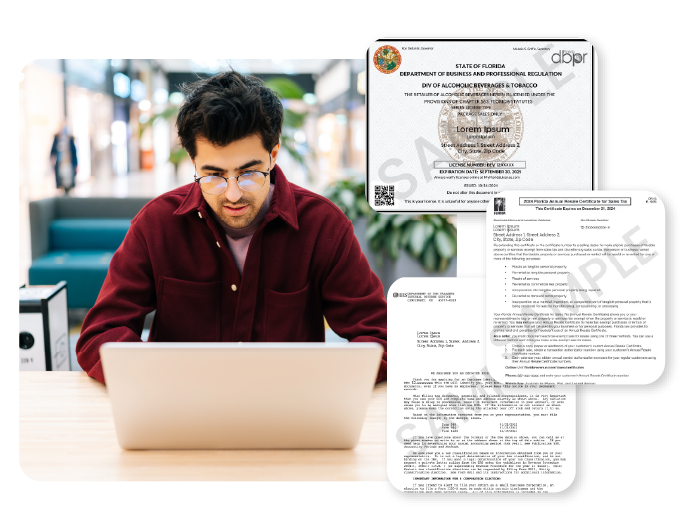

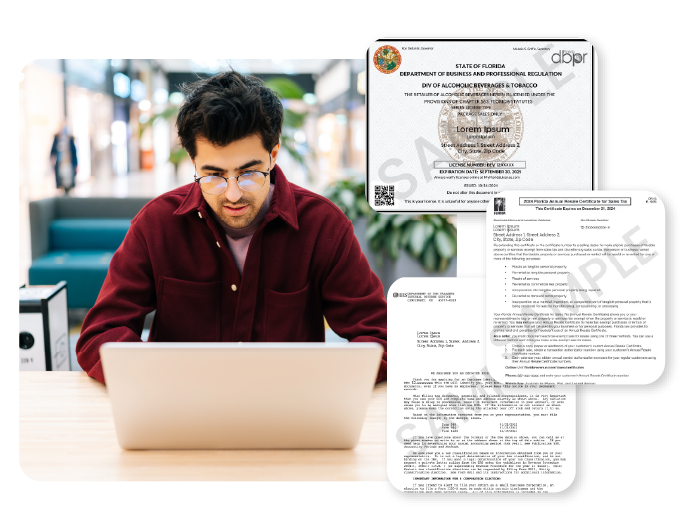

Upload your resale certificate or any other required

business licenses for verification.

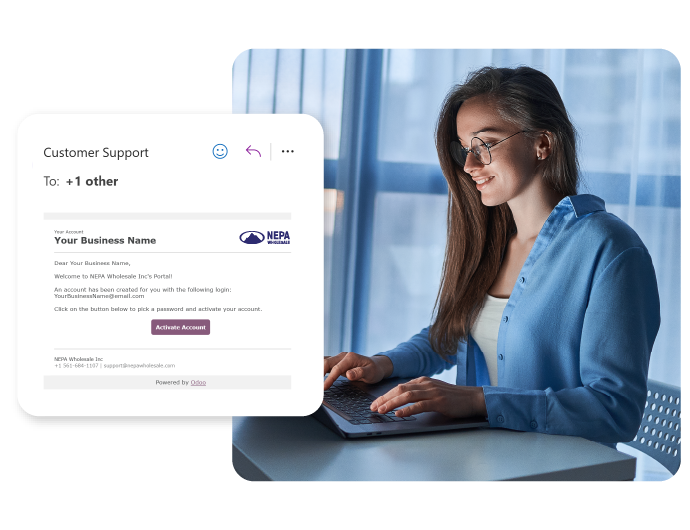

Once your documents are reviewed, you’ll receive an

email confirming your account approval.

Set your password and gain access to our well-stocked

inventory at our exclusive member pricing, all under 15 minutes.

Provide essential business information, including

your company name and contact details.

Upload your resale certificate or any other required

business licenses for verification.

Once your documents are reviewed, you’ll receive an

email confirming your account approval.

Set your password and gain access to our well-stocked

inventory at our exclusive member pricing, all under 15 minutes.

Provide essential business information, including your company name and contact details.

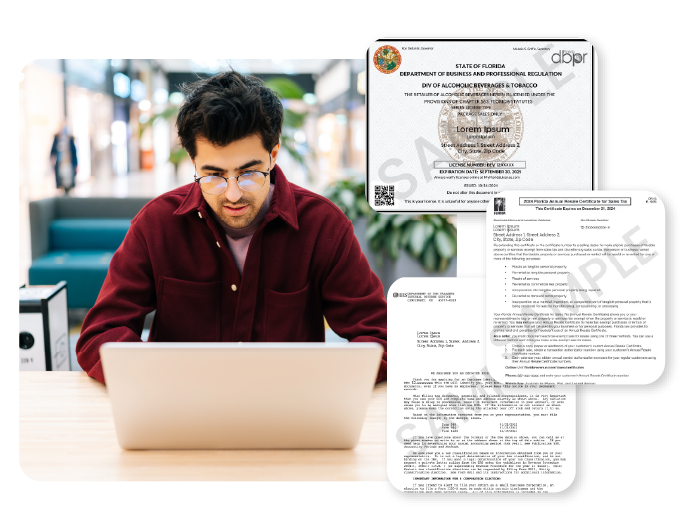

Upload your resale certificate or any other required business licenses for verification.

Once your documents are reviewed, you’ll receive an email confirming your account approval.

Set your password and gain access to our well-stocked inventory at our exclusive member pricing, all under 15 minutes.

"One of the best Wholesalers in the Orlando area. Very clean always stocked up and the staff is knowledgeable and very helpful. Make sure to stop by and check them out for all your Smoke Shop needs! "

"Great shop! You can find all the brands you’re looking for, and the staff is super friendly and helpful. Highly recommend! "

"Most stocked, clean, best priced wholesale out there!! Had everything we needed when no one else did. Rene is the best!! Always ready to help with the great knowledge and quality products. Thank you!! "

We use cookies to provide you a better user experience on this website.

Welcome to NEPA Wholesale

Smoke and Vape Wholesale Distributor

Are you over 21 years of age?

Welcome to NEPA Wholesale

Smoke and Vape Wholesale Distributor

Are you over 21 years of age?

Sorry you are not eligible to visit this website.

Please enter valid date of birth.